The VAT number validation can be done on-demand or automatically, depending on the business transactions, such as “before invoice posting or issue.”

#Vat validation check uk install

It’s easy to install the solution on SAP by an external transport where it is configurable according to business needs. The indirect tax regime is largely based on the OECD standard model. VAT in Israel is operated by the Israel Tax Authority, and Department of Customs and VAT. It was based, at the time, on the UK’s regime. SNI VIES solution is an SAP Add-on that helps you to verify the validity of VAT numbers online. Israel introduced Value Added Tax (VAT) in 1976. Alternatively, you can use software developed by a technology provider to check an EU VAT number. You can do a VAT search and find a VAT number manually on the VIES VAT website of the European Commission.

#Vat validation check uk registration

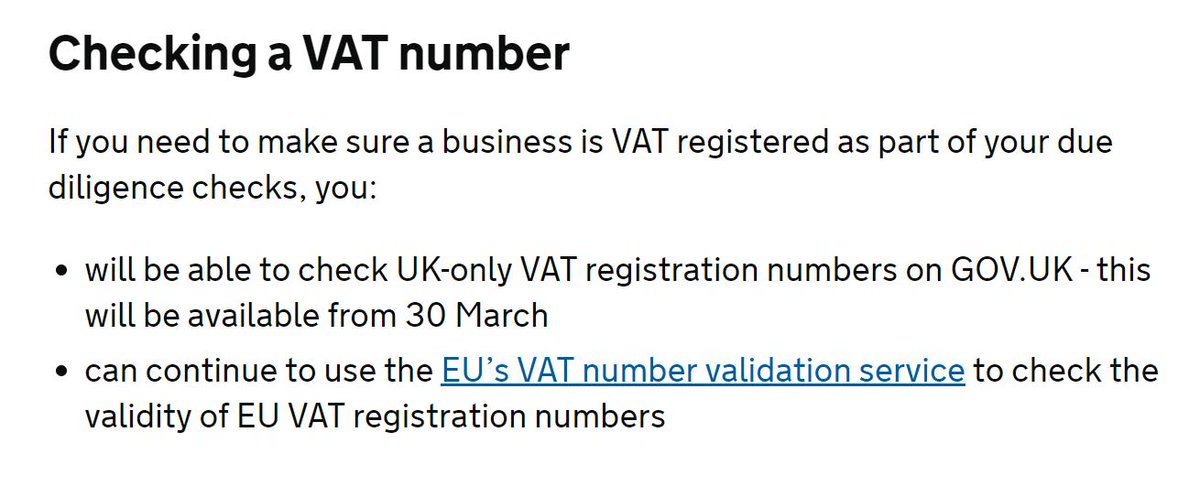

How do I check a VAT registration number? The unit responsible for the control of intra-community trade in each member state, the Central Liaison Office (CLO), has direct access through the VIES system to the VAT registration database of the other Member States. – Enables VAT administrations to monitor and control the flow of intra-community trade to detect all kinds of irregularities. – Enables companies to obtain rapid confirmation of the VAT numbers of their trading partners. Such information includes the VAT identification number and the trader’s name and address.Ī computerized VAT Information Exchange System ( VIES ) was set up to allow for the flow of the data which: For VAT checking purposes, each tax administration maintains an electronic database containing the VAT registration data of its traders.

Therefore, any taxable person making such supplies is encouraged to do a VAT number check of their customers in another member state to see if they hold a valid VAT registration number. Under the new VAT system in the EU, intra-community supplies of goods are exempt from VAT when they are made to a taxable person in another member state, who will account for the VAT on arrival. The most significant benefit was the reduction of the administrative burden on companies, with the elimination of some 60 million customs documents per annum. With the introduction of the single market on 1 January 1993, fiscal customs-based controls at internal frontiers were abolished and a new VAT validation system was put in place for intra-community trade.

0 kommentar(er)

0 kommentar(er)